Recent Posts

Gold In Unprecedented Surge

Posted by on

Gold is now starting to break loose and has broken above the US $1350 Maginot Line at US $1358 last Friday.

It is now only a matter of time before it breaks through the next major resistance level at US $1400. What many people fail to realise is that gold is now at an all time high in Australian dollars, and a Perth Mint one ounce gold kangaroo is currently priced at around $2067, and the bull run hasn’t even started yet.

You would think that mainstream media would be identifying the surge and releasing it to the public. No wonder many people are still in the dark and no wonder so many people relying on this source only hear about it long after the horse has bolted.

I’ve very often said that quoting gold's value in US dollars can be quite irrelevant. What one needs to consider is what you may be able to exchange for your ounce of gold. A Venezuelan family would very much understand that philosophy. Incredibly right now there are 75 countries around the world where gold is priced in their currency at its highest point in recorded history.

This phenomenon is unprecedented.

It used to be typically emerging countries experiencing this fate, but now it’s countries like Australia, England, Canada and Germany that are leading the way with their devaluing currencies, entering the final phase of their final 3 to 4% depreciation against gold, taking them to zero.

With two to three more interest rate cuts coming over the next year, where do pensioners and retirees go from here? There is absolutely no incentive to save as we head towards zero and/or negative interest rates.

What most people fail to realise of course is that gold has outperformed all other major markets over the past 17 years including bonds,the stock market and even Real Estate.

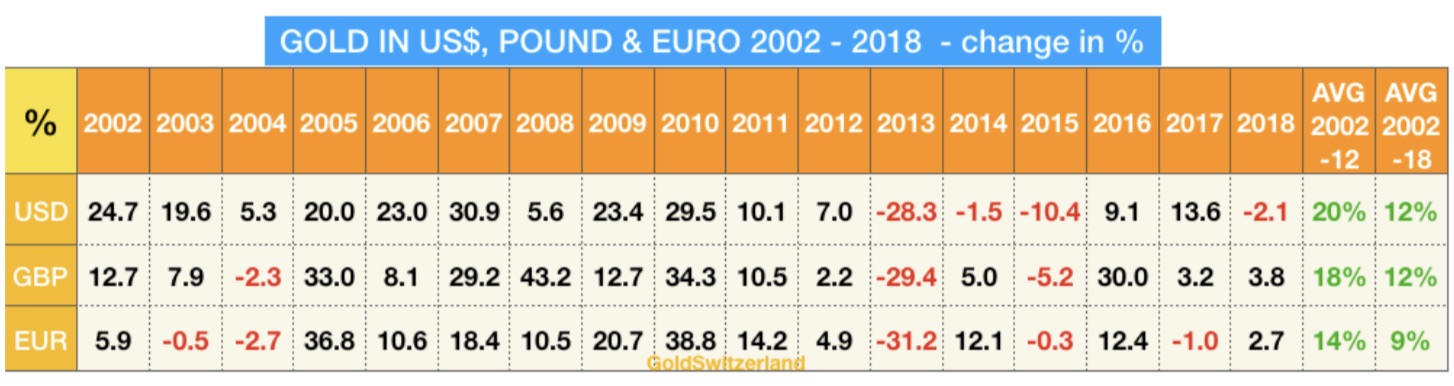

Let’s look at how gold has performed from 2002 through 2018 in three major currencies, namely the US dollar, British pound and the Euro.

The average annual gain for gold in US dollars in that period was 12%, in Pounds 12% and Euro 9%.

Coincidentally in Australian dollars the average annual gain for gold over the same period was 19.5%. I doubt that there would be many real estate investors talking those numbers.

In the last eight months since October, gold is up 17% in Australian dollars and looking like it may repeat that over the next eight months. Just confirming that’s a staggering $90,000 on a $500,000 investment in the last eight months, and has gone completely under the radar.

History can teach us a great deal but we need to be good students.

Where is silver placed you may ask?

Silver in Australian dollars has provided an average annual gain over the same period of 8.8%. Both gold and silver have provided extraordinary returns over the 17 year period, and for most people it has been completely undetected. Silver of course, now sitting at around 90 to 1 ratio to gold represents very low risk with the potential for incredibly high gains.

Silver in this environment has been described by many experts as performing like gold on steroids.

I don’t believe we have long to wait!

Even with interest rates around the world negative to just over 2%, most governments can hardly service the debt, and typically the US debt has doubled every eight years since Reagan became president.

If, and it seems more than likely this continues, by the end of 2020 the US will have a debt of $40 trillion. So governments will continue to do what they have always done and print until the currency goes to zero, and gold and silver will once again provide the ultimate form of wealth preservation and protection of their assets.

AUD

AUD

Loading... Please wait...

Loading... Please wait...