Recent Posts

Get Ready For Currency Collapses

Posted on

With the world hurtling from one crisis to the next, get ready for currency collapses.

Currency Collapse Coming

June 10 (King World News) – Alasdair Macleod: While markets seem becalmed, financial conditions are rapidly deteriorating. Last week Jamie Dimon of JPMorgan Chase gave the clearest of signals that bank credit is beginning to contract. Russia has consolidated its rouble, which has now become the strongest currency by far. The Fed announced the previous week that its balance sheet is in negative equity. And there’s mounting evidence that we have a nascent crack-up boom.

Russia now appears to be protecting the rouble from these developments in the West, while previously she was only attacking the dollar’s hegemony. China has yet to formulate a defensive currency policy but is likely to back the renminbi with a commodity basket, at least for foreign trade. If it is taken up more widely by the members if the Shanghai Cooperation organisation and the BRICS, the development of a new commodity-based super-currency in Central Asia could end the dollar’s global hegemony.

These are major developments. And finally, due to widespread interest in the subject, I examine the outlook for residential property values in the event of a collapse of Western fiat currencies.

The mechanics of an apocalypse

Against the grain of the establishment, for years I have been warning that the world faces a fiat currency collapse. The reasoning was and still is because that’s where monetary and economic policies are taking us. The only questions arising are whether the authorities around the world would realise the dangers of their inflationary and socialistic policies and change course (extremely unlikely) and in that absence in what form would the final crisis take.

History tells us that fiat currencies always fail, only to be replaced by Mankind’s sound money — metallic gold, and silver. And now that fiat currencies have seen a rapid debasement followed by soaring commodity and raw material prices, interest rates should be considerably higher. Yet, in the Eurozone and Japan they are still suppressed in negative territory. The reluctance of the ECB and the Bank of Japan to permit them to rise is palpable. Worse still, even with just the threat of a slowdown in the issuance of extra credit by the commercial banks, we suddenly face a sharp downturn in economic and financial activities.

Commercial banks in the Eurozone and Japan are uncomfortably leveraged and unlikely to survive the mixture of higher interest rates, contracting bank credit, and an economic downturn without being bailed out by their respective central banks. But so massive are the central banks’ own bond positions that the losses from rising yields have put them in negative equity. Even the Fed, which is in a far better position than the ECB and BOJ, has admitted unrealised losses on its bond portfolio are $330bn, wiping out its balance sheet equity six times over.

So, without the injection of huge amounts of new capital from their existing shareholders the major central banks are bust, the major commercial banks soon will be, and prices are rising uncontrollably driving interest rates and bond yields higher. And like a hole in the head, all we now need to complete the misery is a contraction in bank credit. On cue, last week we got a warning that this is also on the cards, when Jamie Dimon, boss of JPMorgan Chase, the largest commercial bank in America and the Fed’s principal conduit into the commercial banking network, upgraded his summary of the financial scene from “stormy” only nine days before, to “hurricane”. That was widely reported. Less observed were his remarks about what JPMorgan Chase was going to do about it. Dimon went on to say the bank is preparing itself for “a non-benign environment” and “bad outcomes”.

We can be sure that the Fed will have spoken to Mr Dimon about this. JPMorgan’s chief economist, Bruce Kasman was then urgently tasked with rowing back, saying he only saw a slowdown. No matter. The signal is sent, and the damage is done.

We are unlikely to hear from Dimon on this subject again. But you can bet your bottom dollar that the cohort of international bankers around the world will have taken note, if they hadn’t already, and will be drawing in their lending horns as well.

The importance of monitoring bank credit is that when it begins to contract it always precipitates a crisis. This time the crisis revolves more around financial assets than in the past, because for the last forty years, bank credit expansion has increasingly focused not on stimulating production of real things — that has been chased overseas, but the creation of financial ephemera, such as unproductive debt, securitisations of securities, derivatives, and derivatives of derivatives. If you like, the world of unbacked currencies has generated a parallel world of purely financial assets.

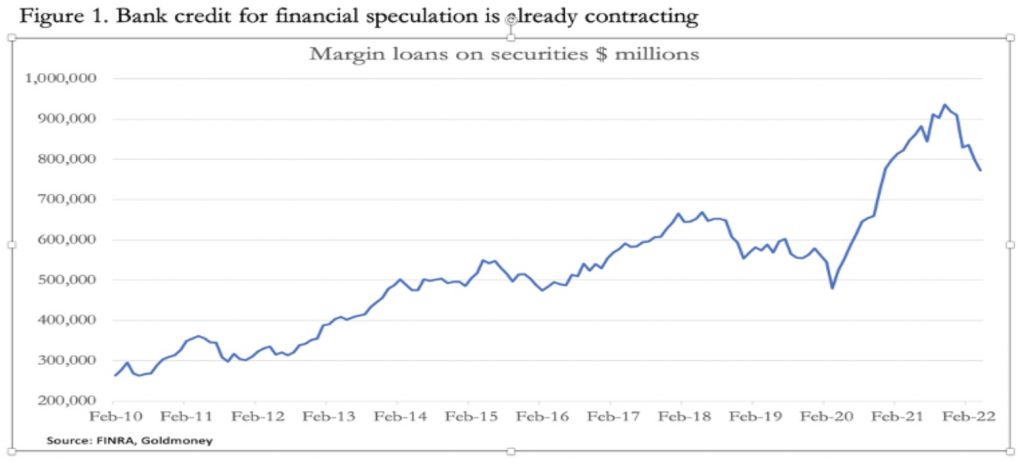

This is now changing. Commodities are creeping back into the monetary system indirectly due to sanctions against the world’s largest commodities exporter, Russia. Financing for speculation is already contracting, as shown in Figure 1. Given recent equity market weakness this is hardly surprising. But it should be borne in mind that this is unlikely to be driven by speculators cleverly taking profits at the top of the bull market. It is almost certainly forced upon them by margin calls, a fate similarly suffered by punters in cryptos.

Bank deposits, which are the other side of bank credit, make up most of the currency in circulation. Since 2008, dollar bank deposits have increased by 160% to nearly $19.5 trillion (M3 less bank notes in circulation). But there is the additional problem of shadow bank credit, which is unknowable and is likely to evaporate with falling financial asset values. And Eurodollars, which similarly are outside the money supply figures will likely contract as well.

We are now moving rapidly towards a human desire to protect what we have. This is fear, instead of the desire to make easy money, or greed. We can be reasonably certain that with the reluctance of banks to even maintain levels of bank credit the move is likely to be swift, catching the wider public unawares. It is the stuff of an apocalypse.

A financial and economic crisis is now widely expected. Everyone I meet in finance senses the danger, without being able to put a finger on it. They are almost all talking of the authorities taking back control, perhaps of a financial reset, without knowing what that might be. But almost no one considers the possibility that this time the authorities will fail to stop a crisis before it turns our world upside down.

Nevertheless, a crisis is always a shock when it comes. But its timing is always anchored in what is happening to bank credit.

AUD

AUD

Loading... Please wait...

Loading... Please wait...